My guiding theme with clients is empowerment: supporting the client to move beyond negative and even crippling stories about money, and come into a positive relationship with managing their money where they feel they are steering things from a place of confidence and pride.

My guiding theme with clients is empowerment: supporting the client to move beyond negative and even crippling stories about money, and come into a positive relationship with managing their money where they feel they are steering things from a place of confidence and pride.

Often people are prompted to come to an accountant for their tax. But more and more of my clients don’t want me just to do it for them. Many people for whom their business is their spiritual path recognise that their growth requires them to address their difficulties with money. One area which is often difficult for people is tax returns.

The shit with tax returns

The most immediate and obvious difficulty with tax returns is a deficit of information. Often people simply don’t know what the rules are about tax, or how those rules apply to their situation, or the meanings of specific terms. And these things are often incredibly difficult to find out. Not knowing what the rules are means most people are operating in a situation in which they don’t know whether they are complying with them or breaking them. In behaviour research, this is widely recognised as the most stressful situation possible.

Another common deficit of information is what you need to tell HMRC, and what you don’t need to tell them. Related to this is not knowing which numbers to add up, so it’s impossible to collect the necessary numbers in an ordered way.

Also with tax returns is the added concern about whether one has the money to pay one’s tax bill. Once the tax return is done then the tax must be paid. But of course we don’t know how much tax we have to pay until we’ve done the return. A vicious circle! Add to this the common shame about not having enough money, and many people simply put off the whole thing.

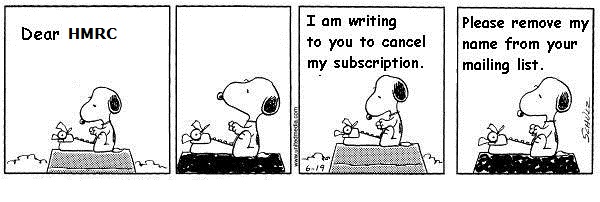

Finally, and most complex, is a very common inner process about authority figures. A tax return in essence reports your money activities to a government authority. So our “authority issues” can readily come into play – often a potent mix of anger and fear which undermines our confidence and can cloud our capacities for mental activities like dealing with data, sorting and categorising, and so on. The combination of authority issues and shame around money can be sufficient to entirely freeze a client and prevent them from taking any action, sometimes for years.

Finally, and most complex, is a very common inner process about authority figures. A tax return in essence reports your money activities to a government authority. So our “authority issues” can readily come into play – often a potent mix of anger and fear which undermines our confidence and can cloud our capacities for mental activities like dealing with data, sorting and categorising, and so on. The combination of authority issues and shame around money can be sufficient to entirely freeze a client and prevent them from taking any action, sometimes for years.

There’s several things I do to reduce the tension for clients around all this. I know what the rules are, so the rules-conflict issue can be readily dissolved simply by sharing that information. And I can also work with the client to estimate their tax bill without them having to file a tax return. Then we can talk about them budgeting to pay their bill, or negotiating a payment plan with the tax authority.

Also in a sense I stand in between the client and the ‘authority’. Because I deal with that authority every day I anchor and embody an attitude of confidence and and personal agency. Even though the client may not feel that within themselves, when they are working with me that confidence and agency is in their field – and so it is there to draw upon to the extent they are able to. I hold a space somewhat akin to a therapeutic space: bracketed off from the full range of day-to-day concerns, so that the client can find the internal space to identify where they are at for themselves around money and recording their money activities.

Tax Coaching

Once they have identified their current relationship with money we can start to change that within the practical activity of doing their bookkeeping together. This is what I call ‘tax coaching’: gradually helping people to be able to do their own tax returns. Actually, filing the return itself is no big deal – it only usually takes about 15-20 minutes online these days. What IS the big deal is doing everything beforehand leading up to the filing: collecting the info about your money, putting it into some sort of ordered format, and assessing the numbers that come out the end.

For many clients all this seems mind-bogglingly complex, or totally overwhelming at first. As we’ve seen above, clients can lack crucial information, are short of money, and have authority stuff running. The idea of then sitting down and learning something entirely new just isn’t anywhere on the board at all.

But it’s definitely possible! Anwar Ravjani, who runs the fabulous bodywork service Embodiment Works, started with me in September 2013. He was determined to grow his business by doing some quite expensive training in a new area, but he had no spare money. He sensed that there was a way to do what he wanted – if he could get out from under the terrible tension he felt around money and dealing with tax.

First I worked with him to record what had been happening with his money in the previous financial year. He had to do this anyway for tax, so it killed 2 birds with the one stone. I showed him how to download all his bank transactions, and how to work with them simply using some spreadsheet tools, to separate business from personal, and add up the business numbers. He had to do this bit by bit – I usually suggest giving yourself some weeks or months to do it in, and to attack only a month’s transactions at a time. This is about breaking down the job into small bits, with time to relax in between. And I was holding a space that knows it is possible to do, and it’s like doing the washing up: a simple procedure that gets done piece by piece.

After some months we had a picture of the 2012-13 year. Then we could see what his actual income was, which prompted him to reflect on his income flow more recently. He was surprised to find it was more solid and more reliable than he’d thought. This then enabled us to look towards the future and do some numbers to see how he could manage paying for the new training. We found that with careful scheduling and some leeway from the trainer it could actually be done. Then we filed his tax return.

I didn’t talk accounts with Anwar for 6 months. Then he contacted me in mid-April saying his work was going better than expected and he was worried he’d have a tax problem. Again the first thing to do was to get some numbers for the previous financial year, which had just finished 2 weeks before. Again this took some time, but it was definitely quicker than the first time now that Anwar was clearer about what was needed.

With the numbers to hand we were quickly able to estimate what tax he would pay. Then we worked out how he could collect that money before the deadline in 9 months time. With this out of the way, we filed his tax return.

Again I didn’t hear from him for a year. Then a few weeks ago he contacted me to say he’d done all his numbers for 2014-15 and could I cast an eye over them; the numbers said this year he would pay no tax, but he didn’t quite believe that. We got together, I did some minor adjustments and we filed his tax return – all of which took less than an hour and a half.

We were both surprised by how quick it was. Anwar said he’d gotten into a pattern of doing his accounts once a month because it was so easy and it gave him a feeling of being in touch with his money. He was delighted in his new-found sense of competence with money, and how that empowered him in his relationship with money in his life. The focus had shifted from tax as a set of fear-inducing unknown rules associated with a threatening authority figure, to tax as a relatively small aspect in a landscape of complete information about money. He reflected that, when we started 2 years ago such a situation seemed impossible.

I’ve found it usually takes three full cycles of doing something to really get the hang of it. For bookkeeping and tax this means doing three years of figures. I’ve now been established in London long enough that several clients have gone through this sort of transition. It is really one of my greatest delights to be on that journey with them and to celebrate yet another member of our community who is empowered around tax.

[…] been working with these clients for 2 or 3 years doing Tax Coaching – working with them around their records, bookkeeping and tax. And, hey – […]

LikeLike